- SOL noticed comparatively muted curiosity from merchants in the course of the weekend pump

- Nonetheless, Santiment deemed the lag as a bullish cue for the altcoin

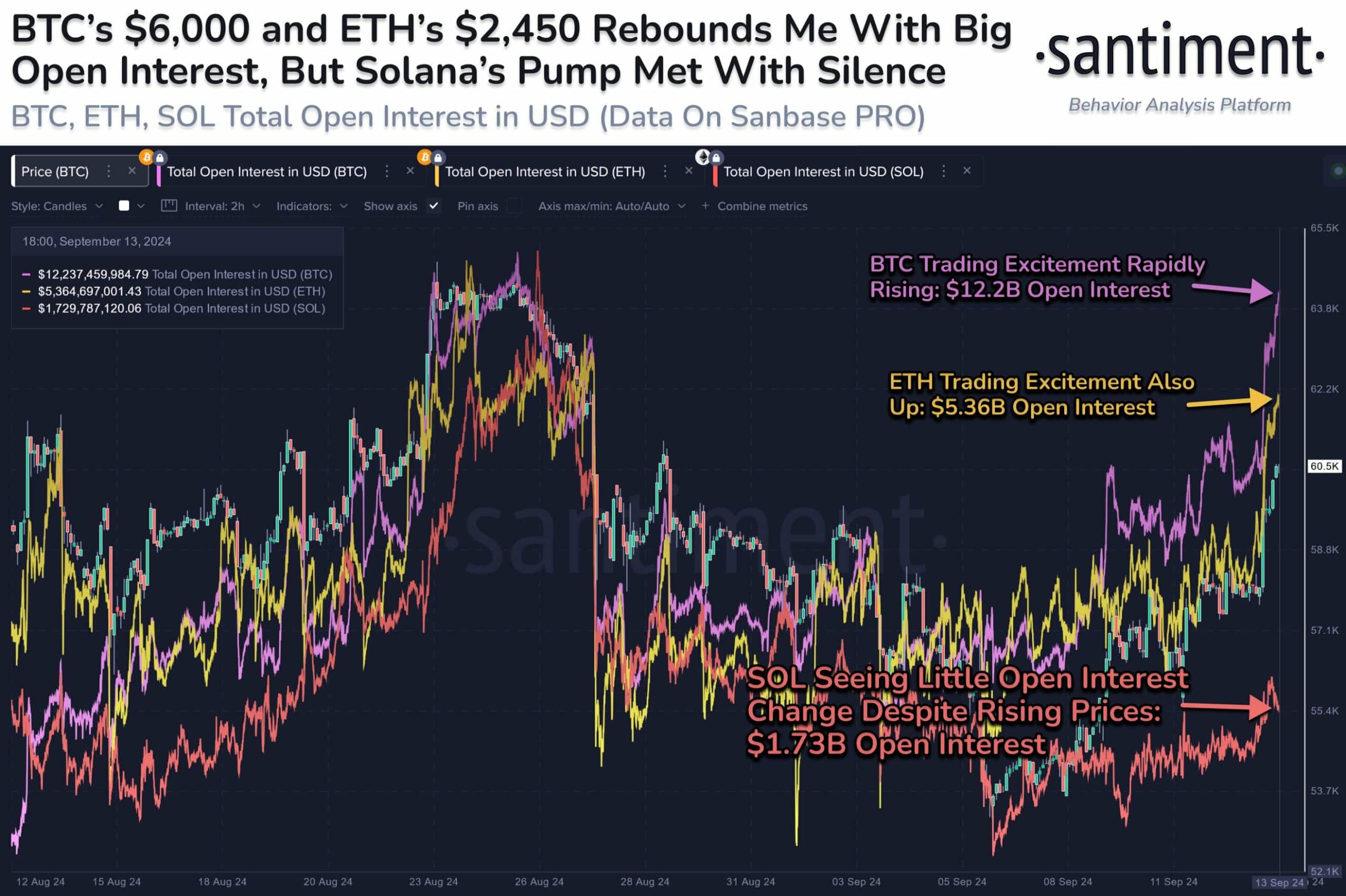

Friday’s market rebound noticed different curiosity from merchants amongst Bitcoin [BTC], Ethereum [ETH], and Solana [SOL]. SOL trailed others in Open Curiosity (OI) charges, which observe curiosity from Futures merchants and general liquidity injection. SOL noticed solely $1.7B in OI, in comparison with BTC’s $12B and ETH’s $5.3B.

Nonetheless, in line with Santiment, the lag may very well be a bullish cue for SOL. The crypto-analytics agency acknowledged,

“Nonetheless, Solana’s personal return above $140 is seeing little or no. Think about this a bullish signal for SOL, as euphoric merchants are trying elsewhere.”

Speculators constructive about SOL

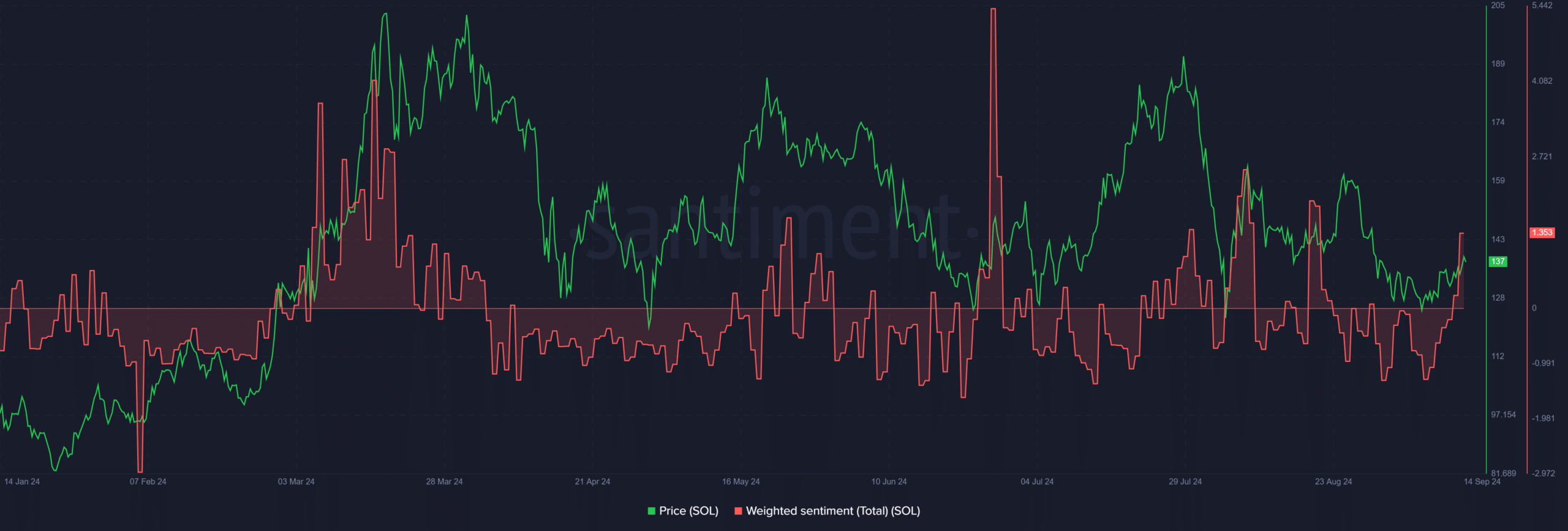

Just like the broader market, the weekend rebound dragged SOL out of unfavorable sentiment territory. At press time, speculators have been extremely constructive in regards to the altcoin for the primary time since late August.

This alluded to a excessive conviction for additional worth appreciation. Nonetheless, decrease timeframe charts recommended in any other case, at press time.

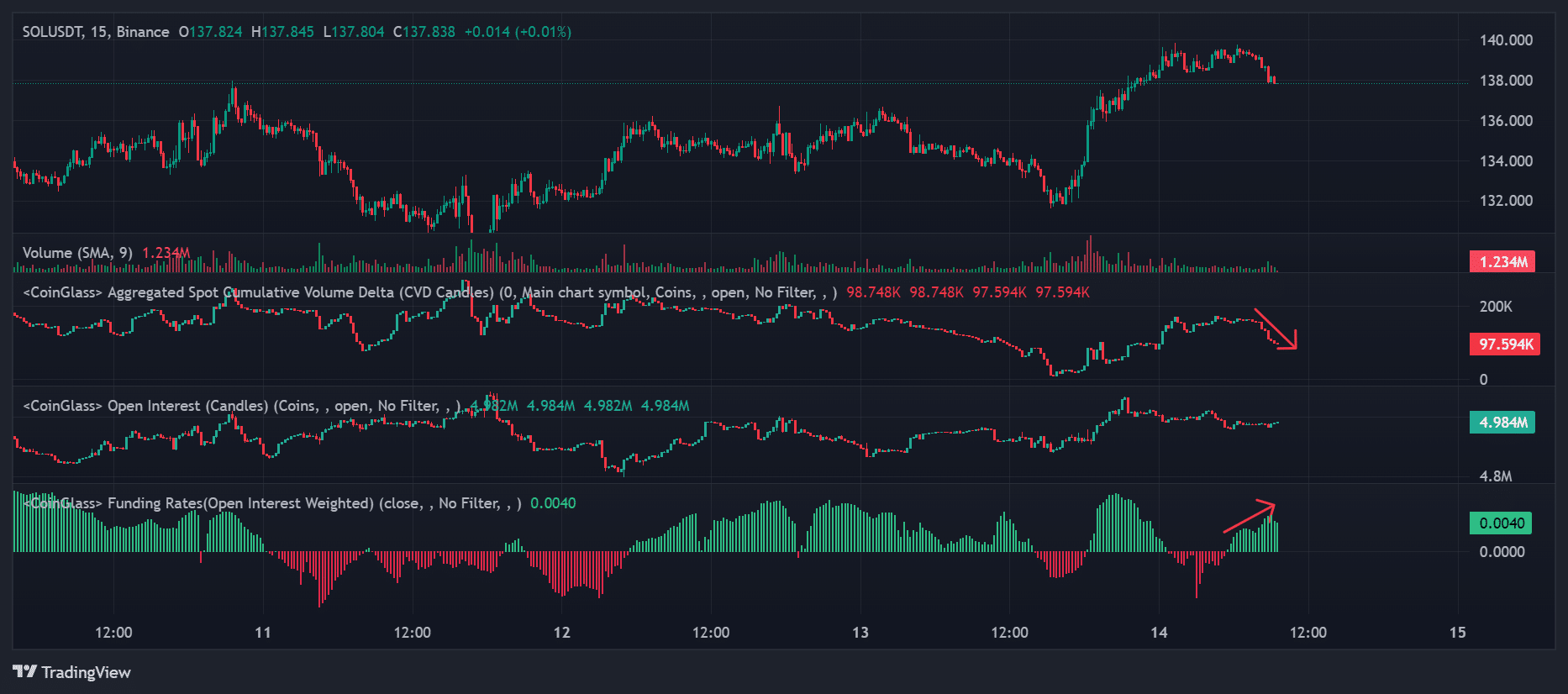

In truth, the aggregated Spot Cumulative Delta (CVD) trended decrease. This highlighted that SOL’s promoting volumes eclipsed its shopping for volumes, indicating that brief sellers hiked as SOL surged in direction of $140.

On the identical time, the OI remained flat. This signaled that some speculators have been making brief bets on the altcoin over the weekend.

Moreover, funding charges fluctuated, illustrating that brief bets might derail a robust weekend transfer above $140.

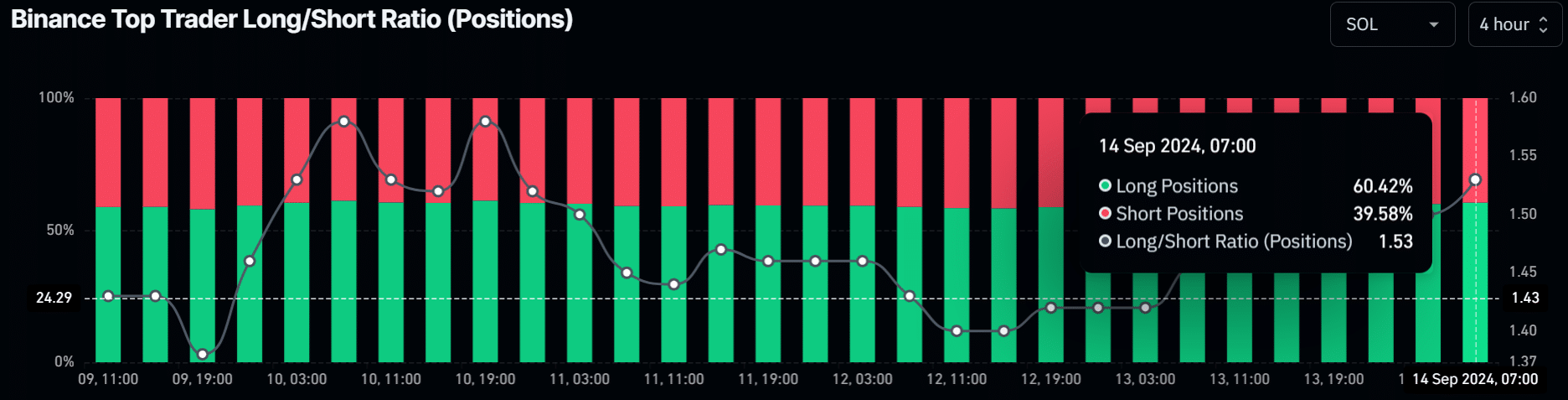

Regardless of the brief bets from retail merchants, sensible cash on Binance doubled down on lengthy positions. In truth, in line with Binance High Dealer Lengthy/Brief Ratio, lengthy positions accounted for 60% of all positions.

Though this demonstrated a excessive conviction for SOL’s upside potential, it might additionally imply a hedge for spot positions.

SOL was valued at $137 at press time, up 7.5% within the final seven buying and selling days after tapping a month-to-month excessive of $139.8.

General, subsequent week might be action-packed for the altcoin. Other than the anticipated bullish pivot from Fed fee cuts on 18 September, Solana’s BreakPoint 2024 occasion might additional induce momentum for the token.

The occasion might be held in Singapore on 20-21 September and is usually related to a worth rally. Particularly since insiders usually unveil the newest updates from the Solana ecosystem.

- SOL noticed comparatively muted curiosity from merchants in the course of the weekend pump

- Nonetheless, Santiment deemed the lag as a bullish cue for the altcoin

Friday’s market rebound noticed different curiosity from merchants amongst Bitcoin [BTC], Ethereum [ETH], and Solana [SOL]. SOL trailed others in Open Curiosity (OI) charges, which observe curiosity from Futures merchants and general liquidity injection. SOL noticed solely $1.7B in OI, in comparison with BTC’s $12B and ETH’s $5.3B.

Nonetheless, in line with Santiment, the lag may very well be a bullish cue for SOL. The crypto-analytics agency acknowledged,

“Nonetheless, Solana’s personal return above $140 is seeing little or no. Think about this a bullish signal for SOL, as euphoric merchants are trying elsewhere.”

Speculators constructive about SOL

Just like the broader market, the weekend rebound dragged SOL out of unfavorable sentiment territory. At press time, speculators have been extremely constructive in regards to the altcoin for the primary time since late August.

This alluded to a excessive conviction for additional worth appreciation. Nonetheless, decrease timeframe charts recommended in any other case, at press time.

In truth, the aggregated Spot Cumulative Delta (CVD) trended decrease. This highlighted that SOL’s promoting volumes eclipsed its shopping for volumes, indicating that brief sellers hiked as SOL surged in direction of $140.

On the identical time, the OI remained flat. This signaled that some speculators have been making brief bets on the altcoin over the weekend.

Moreover, funding charges fluctuated, illustrating that brief bets might derail a robust weekend transfer above $140.

Regardless of the brief bets from retail merchants, sensible cash on Binance doubled down on lengthy positions. In truth, in line with Binance High Dealer Lengthy/Brief Ratio, lengthy positions accounted for 60% of all positions.

Though this demonstrated a excessive conviction for SOL’s upside potential, it might additionally imply a hedge for spot positions.

SOL was valued at $137 at press time, up 7.5% within the final seven buying and selling days after tapping a month-to-month excessive of $139.8.

General, subsequent week might be action-packed for the altcoin. Other than the anticipated bullish pivot from Fed fee cuts on 18 September, Solana’s BreakPoint 2024 occasion might additional induce momentum for the token.

The occasion might be held in Singapore on 20-21 September and is usually related to a worth rally. Particularly since insiders usually unveil the newest updates from the Solana ecosystem.