- The DeFi market capitalization was $67 billion at press time.

- With the Bernstein prediction, the market cap might enhance, getting near its earlier excessive.

In line with a current report by Bernstein, Decentralized Finance (DeFi) is poised to seize better consideration from merchants within the coming weeks.

Whereas the sector remains to be recovering from its 2022 lows, current information reveals promising development in Whole Worth Locked (TVL).

Additionally, as merchants put together for a shift in market dynamics, key property like Chainlink [LINK] and Lido Staked Ether proceed to steer the market.

DeFi set to draw extra merchants

A current report from Bernstein means that Decentralized Finance (DeFi) might see elevated curiosity from merchants within the coming weeks.

According to analysts Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia, the potential for U.S. Federal Reserve price cuts—starting from 25 to 50 foundation factors on Wednesday—might make DeFi yields extra engaging.

Whereas the overall worth locked (TVL) in DeFi remains to be solely half of its 2021 peak, it has doubled from its 2022 low, reaching $77 billion. Moreover, month-to-month customers have surged three to 4 instances because the market’s backside.

Stablecoins have additionally regained momentum, with values round $178 billion, and month-to-month energetic wallets stay regular at roughly 30 million.

DeFi market cap sees decline, however…

In line with information from CoinGecko, the present market capitalization of the DeFi sector is roughly $68 billion.

A more in-depth evaluation revealed that the market had skilled a big decline since April, when its market cap stood at round $116 billion. Since then, substantial losses have occurred.

Nevertheless, based mostly on the current predictions from Bernstein, a rebound in DeFi market capitalization may very well be imminent.

As curiosity in DeFi grows and favorable circumstances come up, resembling potential U.S. Federal Reserve price cuts, the market might recuperate within the coming months.

Chainlink leads asset market

In line with information from CoinGecko, LINK held the second-largest market capitalization amongst DeFi property, following Lido Staked Ether.

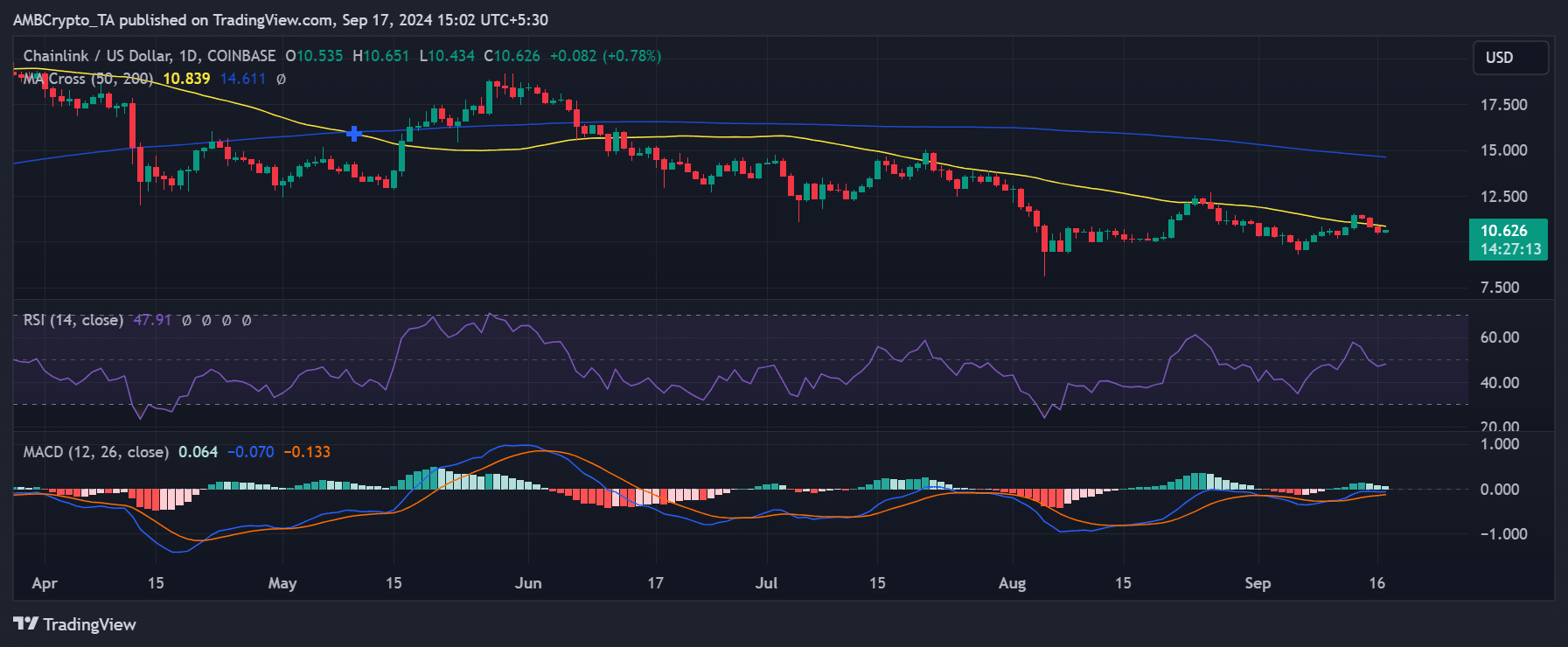

Lido Staked Ether leads with a market cap exceeding $22 billion, whereas LINK has a market capitalization of over $6.4 billion. As of this writing, LINK was buying and selling at roughly $10.60, reflecting a 0.8% enhance.

Regardless of current beneficial properties, LINK beforehand skilled consecutive declines that pushed it beneath its short-term shifting common (represented by the yellow line).

Whereas it briefly broke above this resistance stage on the thirteenth of September, it was unable to maintain the upward pattern, falling again beneath the shifting common.

As DeFi prepares for renewed curiosity from merchants, fueled by potential price cuts and engaging yields, the sector seems primed for a rebound.

Although the market capitalization has seen important declines since April, optimistic developments such because the doubling of TVL and secure person exercise level to a possible restoration.

- The DeFi market capitalization was $67 billion at press time.

- With the Bernstein prediction, the market cap might enhance, getting near its earlier excessive.

In line with a current report by Bernstein, Decentralized Finance (DeFi) is poised to seize better consideration from merchants within the coming weeks.

Whereas the sector remains to be recovering from its 2022 lows, current information reveals promising development in Whole Worth Locked (TVL).

Additionally, as merchants put together for a shift in market dynamics, key property like Chainlink [LINK] and Lido Staked Ether proceed to steer the market.

DeFi set to draw extra merchants

A current report from Bernstein means that Decentralized Finance (DeFi) might see elevated curiosity from merchants within the coming weeks.

According to analysts Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia, the potential for U.S. Federal Reserve price cuts—starting from 25 to 50 foundation factors on Wednesday—might make DeFi yields extra engaging.

Whereas the overall worth locked (TVL) in DeFi remains to be solely half of its 2021 peak, it has doubled from its 2022 low, reaching $77 billion. Moreover, month-to-month customers have surged three to 4 instances because the market’s backside.

Stablecoins have additionally regained momentum, with values round $178 billion, and month-to-month energetic wallets stay regular at roughly 30 million.

DeFi market cap sees decline, however…

In line with information from CoinGecko, the present market capitalization of the DeFi sector is roughly $68 billion.

A more in-depth evaluation revealed that the market had skilled a big decline since April, when its market cap stood at round $116 billion. Since then, substantial losses have occurred.

Nevertheless, based mostly on the current predictions from Bernstein, a rebound in DeFi market capitalization may very well be imminent.

As curiosity in DeFi grows and favorable circumstances come up, resembling potential U.S. Federal Reserve price cuts, the market might recuperate within the coming months.

Chainlink leads asset market

In line with information from CoinGecko, LINK held the second-largest market capitalization amongst DeFi property, following Lido Staked Ether.

Lido Staked Ether leads with a market cap exceeding $22 billion, whereas LINK has a market capitalization of over $6.4 billion. As of this writing, LINK was buying and selling at roughly $10.60, reflecting a 0.8% enhance.

Regardless of current beneficial properties, LINK beforehand skilled consecutive declines that pushed it beneath its short-term shifting common (represented by the yellow line).

Whereas it briefly broke above this resistance stage on the thirteenth of September, it was unable to maintain the upward pattern, falling again beneath the shifting common.

As DeFi prepares for renewed curiosity from merchants, fueled by potential price cuts and engaging yields, the sector seems primed for a rebound.

Although the market capitalization has seen important declines since April, optimistic developments such because the doubling of TVL and secure person exercise level to a possible restoration.